“Can I trade in my car with bad credit? “, someone may ask. They want to know how to do this to get a better price on their new car. Well, there are different ways to accomplish this. Some will be easier than others.

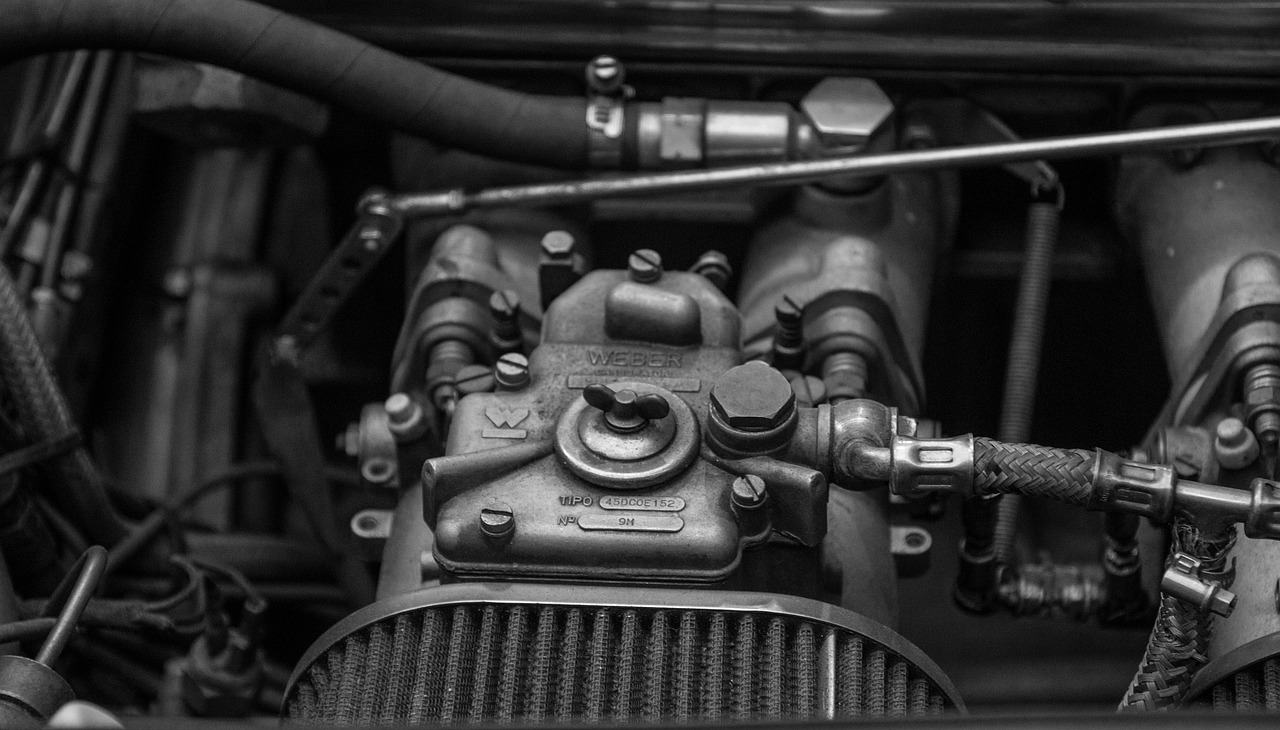

Connect with a verified mechanic in minutes. No appointments. No high fees. No waiting. Get back on the road and enjoy the ride.

Can I Trade In My Car with Bad Credit

Determine Your Monthly Payment

First, you must determine your monthly payment. Now, if you have bad credit you may need to go and get an auto loan. While this is not the only way to accomplish “Can I trade in my car with bad credit? “, you need to remember that it is the easiest way.

Increase Your Credit Scores

If you want to trade in your old car and obtain a better interest rate on your new car loan, you will need to increase your credit scores.

There are many places where you can find your credit scores and increase them. You just need to be careful when finding these places.

When looking for a place to get your credit scores increased, make sure that they tell you that you will not get lower scores. That is the last thing that you would want.

What you should get is the best possible interest rate that you can qualify for. After this, all that is left is to get a good payment plan in place and to drive the car off the lot.

Connect with a verified mechanic in minutes. No appointments. No high fees. No waiting. Get back on the road and enjoy the ride.

Bad Credit Still An Option

If you do not have the money to purchase a new car and just need some extra money to get by until you can pay the bills, you can trade in your used car with bad credit.

It will help you to get back on your feet and to keep up with the payments until you have the money to purchase a new one.

The trade-in value of your car will be taken into consideration by most lenders when you are applying for your new car loan.

The higher the trade-in value, the more money you will save. This is why most people will not think twice about this option.

When you trade-in your old car with poor credit, you are improving your chances of being approved for a better loan.

This means that when you need a new automobile, you will get one at a better rate. Since your credit scores are improved, you will be able to get better terms on your loans.

Avoid Collateral

It can be difficult to find a car loan that does not require collateral. This is why it is important to ensure that you do not have any collateral that will be damaged if you fail to make payments.

In this case, you would still want to get your trade-in so that you can get a lower rate. You may not know how much your trade is worth, so you may be tempted to accept a low figure.

Remember that you need to know how much your car is worth so that you can get the best price. If you accept an offer that is lower than what you would have got from a dealer, you may end up losing your car.

Auto Dealers Would Help

Another option that you may consider to sell your old car and pay cash in exchange is to go to an auto dealer. These dealers will buy your used car and will give you cash in return.

This option allows you to get rid of your old vehicle and get some extra money. However, you should know that you will have to deal with high finance charges on your new vehicle.

If you have bad credit, you may be unable to get a very good interest rate on your trade-in. If you can get a decent interest rate on your car purchase, however, you will find that paying cash for a trade-in is a better option than accepting a low finance charge.

Max Anthony

Max is a gizmo-savvy guy, who has a tendency to get pulled into the nitty gritty details of technology and cars. He attended UT Austin, where he studied Information Science. He’s married and has three kids, one dog and a GMC truck and a Porsche 911. With a large family, he still finds time to share tips and tricks on cars, trucks and more.

Review engine, brake issues, error codes and more with a Mechanic Online in just minutes.

Ask a Mechanic Live Now